Are We Already in Recession?

How shocked would you be if it was announced that the U.S. had just entered a recession, that is, a period in which gross domestic product (GDP) declines (when adjusted for inflation) for two or more quarters?

Would you really be surprised to discover that the eight-year long “recovery,” the weakest on record, had finally rolled over into recession?

Anyone with even a passing acquaintance with the statistical pulse of the real-world economy knows the numbers are softening.

— Auto/light truck sales: either down or off a cliff, depending on how much lipstick has been applied to the pig.

— Restaurant/dining sales: down.

— Tax receipts: down.

— Retail sales: flat, stagnant or down, depending on the sector and if the numbers have been adjusted for inflation/loss of purchasing power.

— Rents in high-rent regions: finally softening after years of relentless increases.

— Consumer debt: hitting new highs.

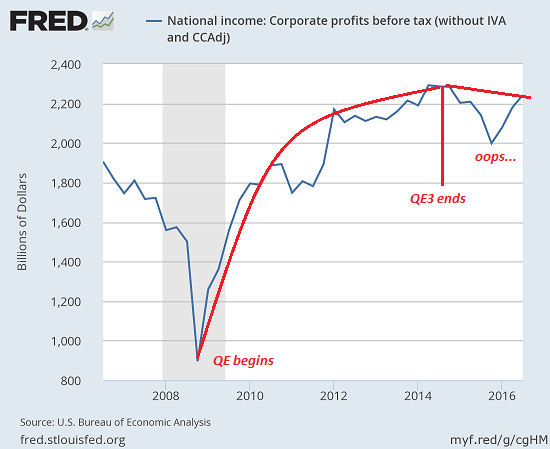

— Corporate profits: stripped of gimmickry, stagnant or down.

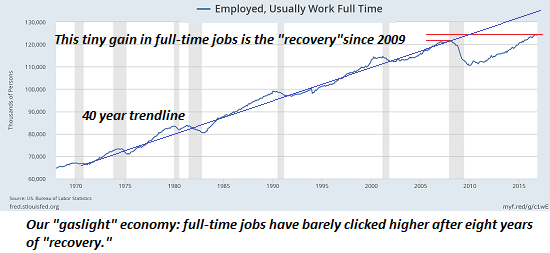

Those who study recessions know that employment often tops out just before the economy rolls over into recession. Strong employment is the last gasp of an expansionary phase.

There are several fundamental reasons why we might be in a recession that manages to avoid the official definition. The starting place is the artificial nature of the eight-year long “recovery” since 2009; in the view of many observers, the economy never really exited the 2008-09 recession.

Those in this camp look at fundamentals, not the stock market, which has been held up as a proxy for the real economy, when in fact it is only a proxy for financialization and official selection of the market as the (easily manipulated) signifier of economic vitality and prosperity.

Recessions are supposed to clear the financial deadwood–failed enterprises are liquidated, borrowers who are in default are bankrupted, and bad debt is wiped off the books via the acceptance of losses.

The story of the “recovery” 2009-2017 is that these clear-the-deadwood dynamics were suppressed. Rather than accept painful losses, the authorities saved bankrupt banks and encouraged a Zombie Economy in which zombie borrowers and enterprises are kept alive via low-cost loans and the masking of default via financial trickery: student loans that are non-performing, for example, aren’t labeled “in default;” they’re placed in a zombie category of forgiveness without actual writedowns of the debt.

If households can no longer afford to pay interest on new debt, the “solution” in a Zombie Economy is to offer them 0% loans. If corporations need to roll over debt, the Zombie Economy “solution” is the companies sell near-zero yield bonds to credulous investors.

If households can no longer afford to buy homes, the Zombie Economy “solution” is for federal agencies such as FHA to offer near-zero down payment mortgages and guarantee private lenders against any loss.

When these agencies get into trouble due to the horrendous costs of encouraging uncreditworthy borrowers to take on debt they can’t afford, the “solution” is for the taxpayers to fund yet another $100 billion bail-out.

The stark reality is fulltime jobs, productivity and profits are all subpar. As I have noted many times, wages for the bottom 95% have gone nowhere since 2000 when adjusted for inflation. Households can no longer afford more debt unless it’s at near-zero rates of interest.

Fulltime employment–the bedrock of consumer spending and borrowing–has barely moved in eight years. Part-time waiters can’t afford to buy homes or new vehicles.

Wealth and income can only be generated in the real world by increases in productivity. Unfortunately for the “recovery” narrative, productivity is tanking.

Corporate profits are also going nowhere.

In essence, the “recovery” economy is a zombie economy living on great gulps of new debt that it can’t service. As sales, profits and tax receipts weaken, eventually employment weakens, too, as employers trim costs by cutting positions, hours worked, etc.

Eventually, zombie borrowers give up trying to service unpayable debts, zombie companies close their doors, and the illusion of “growth” collapses in a heap of corrupted numbers and false signifiers.

The “recovery” game will shift to massaging GDP so it ekes out .1% “growth” every quarter until Doomsday. The Zombie Economy can be kept alive indefinitely–look at Japan–but it not a healthy or vibrant or equality-opportunity economy; it is a sick-unto-death economy of fake narratives (growth is permanent) and fake statistics (we’ve revised previous numbers so that, surprise, GDP is still positive.)

If we stop counting zombies, we’re already in recession.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

Leave a Reply