Buy Gold As Washington “Stumbles” Advise Blackrock

– Gold set to shine as Washington stumbles

– “Bet on gold’s diversifying properties rather than political stability”

– World’s largest asset manager believes Trump and political drama in the U.S. means gold likely to rise

– Real rates flattening out and rising political instability – Blackrock’s Koesterich

– “For now my bias would be to stick with gold” – Blackrock

– U.S. debt ceiling issue to be fractious as bankrupt U.S. hits $20 trillion debt

– Investors will again turn to gold in coming political strife

“For now I would prefer to bet on gold’s diversifying properties rather than political stability” – Russ Koesterich, Blackrock.

Not for the first time this year, Blackrock’s Koesterich has spoken about his faith in gold during times of both financial and political instability.

Those times are now, the world’s largest money manager believes. Since the beginning of the year Koestrich has been adding to the gold position of the $39bn Global Allocation Fund. Gold is now the fund’s second-largest position.

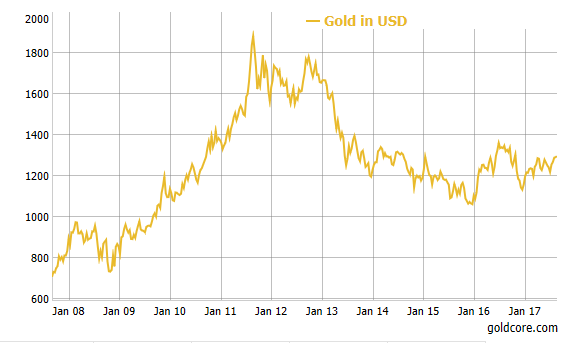

Gold’s performance, up 12% year-to-date, is particularly interesting. A hard-to-define asset, gold is often thought to perform best when either inflation and/or volatility is rising. This year has been notable for both falling inflation and record low volatility, raising the question: What is powering gold’s ascent and can it continue? Two trends stand out:

Real rates have flattened out

Political uncertainty has risen

Real rates – plateauing and boosting gold

Gold is most correlated with real interest rates (in other words, the interest rate after inflation), not nominal rates or inflation. While real rates rose sharply during the back half of 2016, the trend came to an abrupt halt in early 2017. U.S.10-year real rates ended July exactly where they began the year, at 0.47%. The plateauing in real yields has taken pressure off of gold, which struggled in the post-election euphoria.

Heightened political uncertainty

Click here to read full story on GoldCore.com

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Leave a Reply