Gold Coins and Bars See Demand Rise of 11% in H2, 2017

– Gold coins, bars see demand rise of 11% in H2, 2017 to 532 tonnes according to WGC Gold Demand Trends

– Gold investment demand strong in China, India & Turkey

– Demand in Turkey surges on double digit inflation

– Total gold demand declines in Q2 on slower U.S. ETF inflows

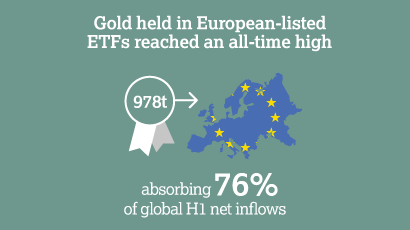

– Gold held in ETFs in Europe reached all time high of 978t

– U.S. ETF inflows slowed from last year’s record

– Central banks continue to buy – 94t of declared purchases

– Turkey joined Kazakhstan & Russia in buying gold

– Well balanced market: ETF inflows continue and jewellery, technology and bar & coin demand up

– Important to note this is all official, transparent and recorded demand. There is demand and flows of gold that cannot be and are not recorded – especially into the Middle East, India, Russia and of course China

Key findings included in the Gold Demand Trends Q2 2017 report are as follows:

- Overall demand was 953t, a fall of 10% compared with 1,056t in Q2 2016

- Total consumer demand rose by 9% to 722t, from 660t in the same period last year

- Total investment demand (ETFs) fell 34% to 297t compared with 450t in Q2 2016

- Gold coins and bars rebounded 13% in H1

- Global jewellery demand grew 8% to 481t, from 447t in the same period last year

- Central bank demand climbed 20% to 94t compared with 78t in Q2 2016

- Demand in the technology sector increased 2% to 81t compared with 80t in Q2 2016

- Total supply was down 8% to 1,066t, from 1,160t in the same period last year

- Recycling fell 18% to 280t compared with 343t in Q2 2016

Click here to read full story on GoldCore.com….

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Leave a Reply