Gold, Silver Consolidate On Last Weeks Gains, Palladium Surges 36% YTD To 16 Year High

– Gold and silver rise as stocks fall sharply after Barcelona attack

– Gold, silver 0.6% higher in week after last weeks 2%, 5% rise

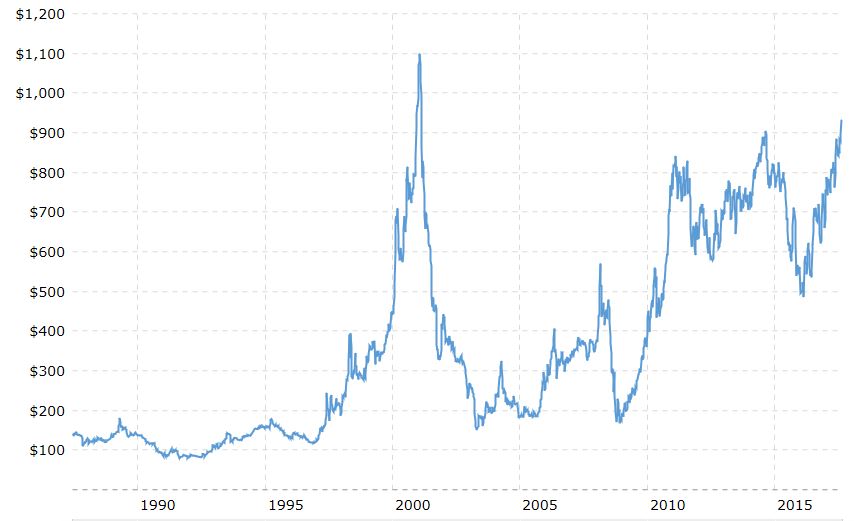

– Palladium +36% ytd, breaks out & reaches 16 year high (chart)

– Gold to silver ratio falls to mid 75s after silver gains last week

– Perfect storm of financial and geopolitical tensions is driving safe haven demand and should see higher prices

– Weekly close over $1,300 could see gold quickly test $1,400

– Palladium at 16 year highs today; gold, silver in coming months?

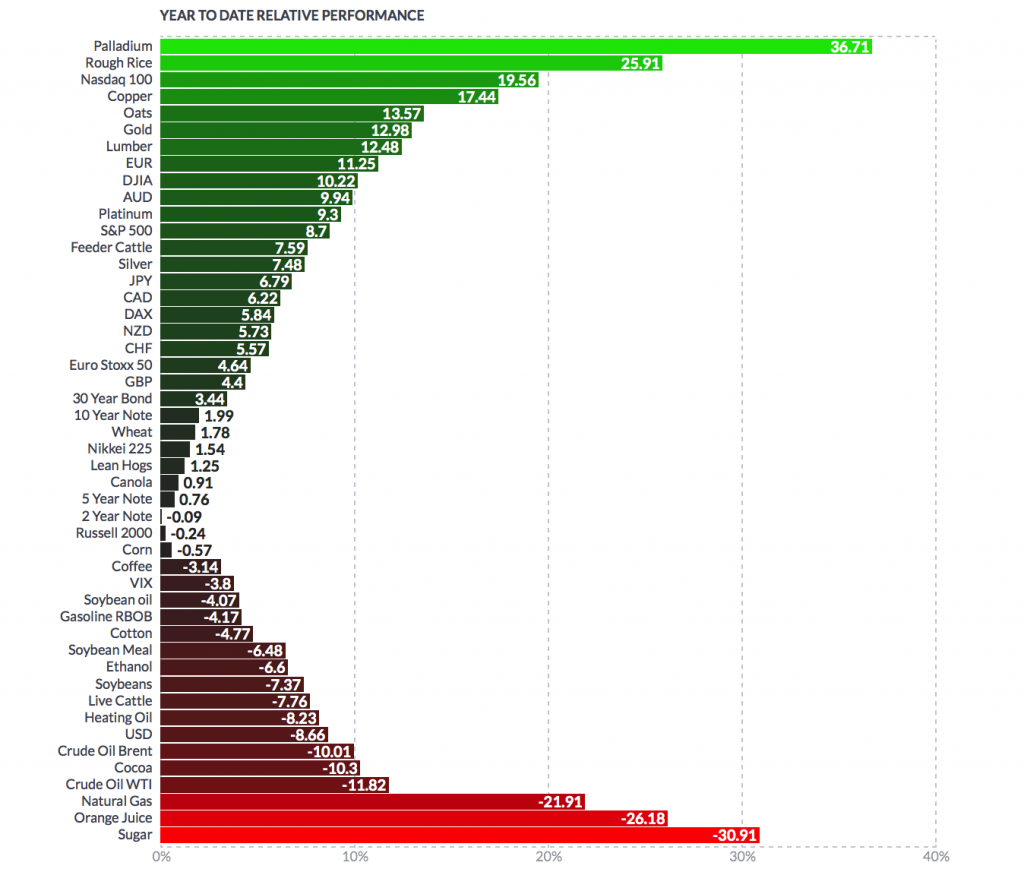

2017 YTD Relative Performance (Finviz)

Editor Mark O’Byrne

This morning readers woke to the news that a second attack in 24 hours had taken place in Barcelona. So-called Islamic State claimed responsibility for the attacks in Spain.

Global stocks has fallen and precious metals have eked out gains this morning as investors seek out safe haven assets. Gold has risen to trade at its highest level since the beginning of June.

Gold’s reaction to the Barcelona events is likely to last and may continue today. The combination of heightened risk in the global geopolitical sphere is likely to support both gold and silver, pushing them through recent resistance. A weekly close above $1,300 per ounce will be very positive for gold and should see a rapid move to test the $1,400 level.

Gold and silver outperforming stocks

After losses earlier in the week, gold and silver have come right back and are now up 0.55% and 0.64% respectively. This is very positive as profit taking was to be expected after last weeks strong gains.

Gold and silver have consistently remained in the top-performing assets throughout the year and are beginning to outperform stocks.

In the year to date, gold is up nearly 13% whilst silver has climbed over 7.5%. The benchmark S&P500 is up 8.6% after weakness last week and this.

Both precious metals have performed well thanks to safe haven demand, much of which has been driven by very strong demand in India, China and Asia and ETF-demand in Europe.

Palladium at 16 year highs today; gold and silver in coming months

Palladium is up over 36% in the year-to-date and is the best performing commodity and market this year.

Palladium in USD – 20 Years (Macrotrends.net)

Consumption of the rare industrial precious metal is expected to hit 10.8 million ounces this year, an all-time high. Demand from the automotive industry, the biggest buyer of the metal, is up 4% this year.

Click here to read full story on GoldCore.com

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Leave a Reply