What the Mainstream Doesn’t Get about Bitcoin

I’ve been writing about cryptocurrencies and bitcoin for many years. For example: Could Bitcoin Become a Global Reserve Currency? (November 7, 2013)

I am an interested observer, not an expert. As an observer, it seems to me that the mainstream–media, financial punditry, etc.–as a generality don’t really grasp the dynamics driving bitcoin and the other cryptocurrencies.

What the mainstream does get is speculative frenzy. New technologies tend to spark speculative manias once the adoption rate exceeds the Pareto Distribution’s critical threshold of 4%, and opportunities to buy into the new technology become available to the general public.

Just as radio and the Internet sparked speculative manias in their boost phase, cryptocurrencies have sparked their own speculative frenzy.

Where the mainstream goes wrong is assuming that’s all there is to bitcoin: a speculative mania. The Establishment often dismisses transformative technologies as fads or gimmicks; thus the infamous rejection of photocopy technology as only of interest to a dozen large corporations, personal computers belittled as being of limited utility (storing kitchen recipes), and so on.

New transformative technologies develop in an unpredictable fashion, and early-phase critics and prognosticators often end up looking foolish on both ends of the spectrum: by dismissing the transformative potential of the new technology (Paul Krugman’s famous obituary for the Internet in the late 1990s) or by making fantastic claims that exceed the reach of the current technology.

The mainstream also misses the core driver of bitcoin and cryptocurrencies: the current financial system is doomed, and some other arrangements will emerge. Those who get on board alternative arrangements early will likely preserve more of their wealth than those who believe the current system is permanent, and some may earn great wealth as capital flees the sinking ship of central banking/credit for more secure climes.

The inevitable collapse of the fully financialized exploitive Empire of Debt is verboten in the mainstream, for obvious reasons. The herd is already restless, as it intuits the present faux “prosperity” is fragile, and so the mainstream’s job, as it were, is to maintain the delusion that the exploitive Empire of Debt is permanent and the only possible financial system.

The herd also intuits that an Elite that lies when it gets serious cannot be trusted. As all the internal contradictions and excesses of the present financial system weaken its foundations, financial and political Elites must obfuscate, lie and manipulate via gamed statistics, false narratives and media spin lest the increasing instability panic the unsettled herd.

The third dynamic the mainstream misses is the potential role of bitcoin in preserving the wealth of the very Elites who best understand the weaknesses of the present financial system. A number of very smart people assure me the U.S. government can (and will) shut down bitcoin overnight by restricting or outlawing exchanges’ access to the banking systems’ payment platforms that enable people to exchange bitcoin/ fiat currencies.

My response is this question: what will best serve the interests of the wealthy and super-wealthy? If this sucker’s going down, to quote former President G.W. Bush, those with wealth and political power are not going to allow regulators to seal an escape hatch that might serve their goal of wealth preservation.

The current interest of hedge funds and other managers of wealth in bitcoin suggests this is precisely how bitcoin is being perceived. This interest will only increase as the seams of the current financial system start unraveling.

If bitcoin is perceived as a threat to Elite wealth preservation, the Elites will deploy their political power to suppress bitcoin. But I consider this unlikely, for a reason rich in irony: bitcoin’s independence from the fiat/central bank credit system that has enriched the few at the top of the pyramid at the expense of everyone else is the very reason it offers more stability than the doomed-to-devaluation credit-bubble currencies.

Given bitcoin’s tiny share of global wealth, how much of a threat can it pose to the super-wealthy elites?

I suspect the big wealth managers are only beginning to get interested in bitcoin; the Early Adopters tend to be small players with larger appetites for risk than the institutional players.

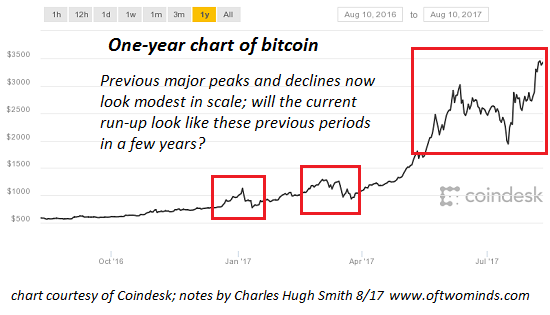

I’ve marked up a chart of bitcoin to suggest there may be a fractal pattern in play: notice the previous two periods of volatile upswings and downdrafts. The 30+% swings appeared monstrous at the time, but looking back, they look more like blips.

What will the current dramatic run-up, sharp decline and new high above $3,400 look like from the heights of $10,000?

As I have said before, the real demand for bitcoin will not be known until a global financial crisis guts confidence in central banks and politicized capital controls. Only then will we know for sure how the financial and political Elites will view bitcoin: as a threat to their wealth or as a lifeboat with precious few seats.

Of interest:

Projecting the Price of Bitcoin June 2, 2017

The Path to $10,000 Bitcoin January 11, 2017

An Everyman’s Guide To Understanding Cryptocurrencies June 13, 2016

Understanding the Cryptocurrency Boom (and its Volatility) June 30, 2017

Why Don’t the U.S. Dollar and Bitcoin Drop to Their Tangible Value, i.e. Zero? January 9, 2017

Where Will All the Money Go When All Three Market Bubbles Pop? October 13, 2016

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

Leave a Reply