Bitcoin Falls 20% as Mobius and Chinese Regulators Warn

– Bitcoin falls 20% as Mobius and Chinese regulators warn

– “Cryptocurrencies are beginning to get out of control” – warns respected investor Mark Mobius

– Mobius believes governments will begin to clamp down on cryptocurrencies sparking rush to gold

– Yesterday China’s PBOC ruled Initial Coin Offerings (ICOs) are illegal and all related activity to halt

– China is home to majority of bitcoin miners

– Paris Hilton latest celebrity to support an ICO

– Gold’s return of 16% YTD look ‘dull’ or ‘stable’?

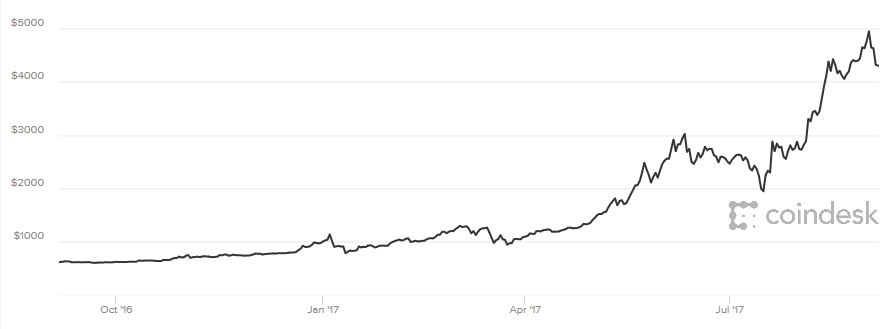

– Bitcoin fell 23%, now down 16% from $5,000 high

Editor: Mark O’Byrne

Bitcoin in USD 1 Year (Coindesk)

Bitcoin in USD 1 Year (Coindesk)

An ICO – “unregulated issuances of cryptocoins where investors can raise money in bitcoin or other [cryptocurrencies]”

Financial Times

Just as you thought you were getting your head around bitcoin and all the other hundreds of cryptocurrencies out there, the financial headlines are screaming at you about something called initial coin offerings or ICOs. Now you don’t really know what’s going on.

The latest news in the crypto world is that the People’s Bank of China (PBOC) announced yesterday that ICOs (Initial Coin Offering) are illegal and that all related fundraising activity should cease immediately.

But what is an ICO?

An ICO is like an IPO but kind of in reverse. It is a tool that trades future cryptocoins in exchange for cryptocurrencies of immediate, liquid value. You exchange bitcoin or ethereum with the underlying company in exchange for a new token, say ‘ISawYouComing Coin’

A more formal explanation is offered by Travis Scher:

An ICO is a crowdsale of cryptographically secured blockchain tokens to fund the development and operation of one of three types of blockchain projects:

A platform-layer blockchain (such as ethereum or Lisk)

An organization that operates on a blockchain (known as a decentralized autonomous organization (‘DAO‘), or a centrally organized distributed entity (‘CODE‘)

A decentralized application (‘dapp’) that runs on a platform-layer blockchain. Tokens that fund these are sometimes known as appcoins.

So far in 2017 $1.366 billion has been raised in ICOs. In global market terms they are still relatively small. But when you consider that US startups raised just $11 billion through IPOs in the second-quarter of this year then you can appreciate the rapid growth in the space.

Click here to read full story on GoldCore.com

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Leave a Reply