Bitcoin, Sour Grapes and the Institutional Herd

If I had a bitcoin for every time some pundit declared bitcoin is a bubble, I’d be a billionaire. There are three problems with opining that bitcoin and cryptocurrencies are bubblicious:

1. Everything is in a bubble now: stocks, bonds, housing, heck, even bat guano is bubblicious. Exactly what insight is being added by yet another guru repeating the BTC is a bubble meme?

2. What’s the value proposition in declaring BTC is in a bubble? Spotting bubbles is like shooting fish in a barrel; the value proposition is in identifying the price/time tipping point at which bubbles pop.

3. Declaring bitcoin is a bubble is starting to sound like sour grapes. Sour grapes defined: those who missed the 10-bagger (never mind the 100-bagger) feel better by dismissing the whole thing as a fad and a bubble, but as BTC continues marching higher, it looks like they missed the boat but are too proud to admit they didn’t grasp the significance of cryptocurrencies and BTC in particular.

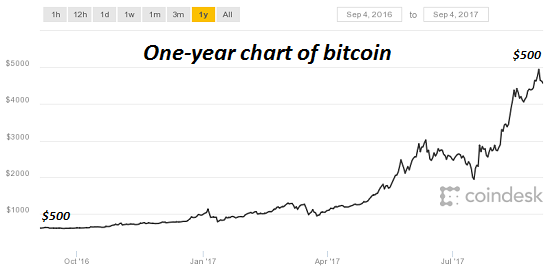

For those who don’t know what the fuss is about, here’s a one-year chart of bitcoin (BTC). Note the increase from $500 to $5,000 ($4.500 as I write this). Some initial coin offerings have made gains that make this mere 10-bagger look like small change.

This might look like a speculative side-game, but for institutional money managers, it’s getting serious. As we all know, it’s becoming increasingly difficult to manage money such that the returns on the managed money exceed the return of an S&P 500 index fund.

If a passive index fund does better over five years than an actively managed fund, then what the heck are we paying the fund managers big bucks for?

This is a question that occurs to everyone with money in a pension fund, mutual fund, insurance company, etc. Why are we paying these guys and gals annual salaries of $250,000 plus bonuses if they’re missing out on the big winners like bitcoin?

Let’s stipulate up front that no institutional money manager can speculate in the cryptocurrency equivalents of penny stocks, i.e. ICOs (initial coin offerings). The risk management rules of serious money funds preclude this sort of rampant speculation, no matter how potentially lucrative.

But bitcoin is different. It’s been around the longest, and has survived all the slings and arrows of outrageous fortune tossed at it. Despite a much-dreaded hard-fork (greetings, BTC Cash), the original bitcoin still operates by the initial conditions set by the creator(s): there can only be 21 million bitcoins issued, and the management of the blockchain is not controlled by a central agency (though some miners are more equal than others–but that’s a thicket to explore another time).

Bitcoin is tailor-made for institutional ownership. While it is inherently volatile, it is stable and transparent; there is no “insider trading” or financial trickery (such as bogus financial statements) to be wary of. Unlike many other investment vehicles, it’s highly liquid.

Once exchange-trade funds (ETFs) based on direct ownership of BTC are widely available, this opens the door wider to both institutional and mom-and-pop investors.

All of this puts pressure on institutional money managers to buy some bitcoin so they don’t look like they missed the investment vehicle of the decade. Never mind when you bought it, or at what price; better to get in now before the price jumps even higher. Going forward, it will be this simple: either you own bitcoin or you’re out of a job.

This is the same reason virtually every institutional money fund owns Apple (AAPL)–if you don’t own Apple, then you missed out on the decade’s greatest investment story. So if your fund lags index funds, and has no ownership of Apple, Facebook, Netflix, Amazon and Tesla– here’s your pink slip, buddy–you blew it.

But wait–I bought bitcoin at $3,000, and added at $4,000! Hmm. Smart move. Maybe there’s hope for you yet.

The point is institutional ownership of bitcoin is in the very early stages. As bitcoin continues to advance, institutional money managers will be forced to buy in, just to avoid the fate of those who failed to buy Apple.

Money managers buying now at $4,500 will look like geniuses when it hits $10,000, and everybody who dismissed BTC as a bubble at $5,000 will face a bleak choice–either get some bitcoin in the portfolio or prepare for a pink slip.

When the institutional herd starts running, it’s best not to get trampled.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

Leave a Reply