Gold Is Better Store of Value Than Bitcoin – Goldman Sachs

– Gold is better store of value than bitcoin – Goldman Sachs report

– Gold will continue to perform well thanks to uncertainty and wealth demand

– Bitcoin’s volatility continues to impact its role as money

– Gold up 12% in 2017, bitcoin over 600%

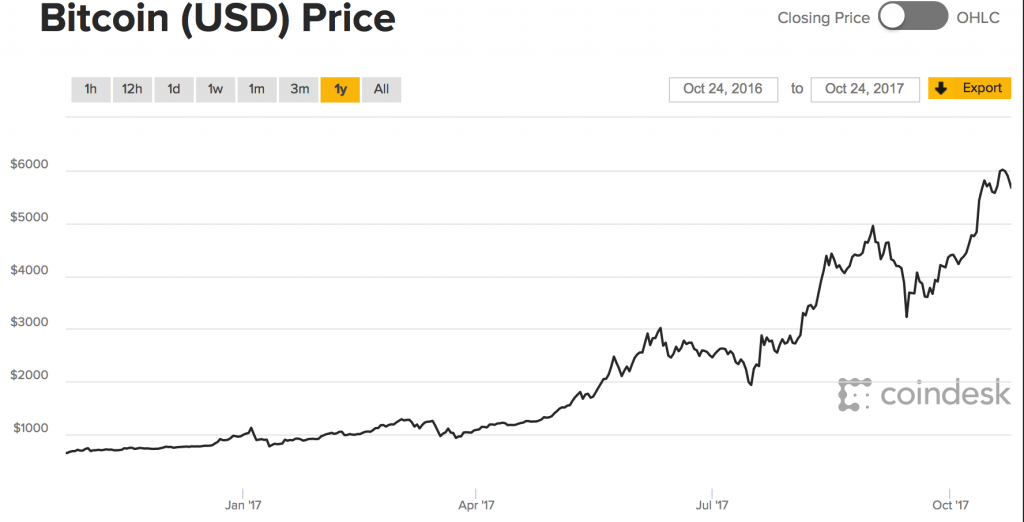

– BTC is six times more volatile than gold – see chart

– Gold’s history and physical property shows it meets requirements as a medium of exchange and store of value

Since the birth of bitcoin there has been one question that has repeatedly grabbed headlines and led debates all over the world – will bitcoin replace gold?

The latest to weigh in on this question is Goldman Sachs which, in a research note entitled ‘Fear and Wealth’, has concluded that gold is better than bitcoin.

Examining gold and bitcoin against the key characteristics of money, the report concludes that “Precious metals remain a relevant asset class in modern portfolios, despite their lack of yield…They are neither a historic accident or a relic.”

Goldman Sachs looked at four key properties of a long-term store of value – durability, portability, intrinsic value and unit of account – concluding that the reasons why gold was originally adopted remain relevant to today.

They believe as the level of uncertainty increases investors increase their exposure to gold. Fear is the medium to short-term driver of the gold price. The long-term driver, Goldman Sachs believes, is wealth.

The debate of gold versus bitcoin is really a rather tedious one. So rarely do you see any other two assets pitched against one another. Yet those choosing to debate it manage to find common ground between the two, so the debate rages on. Bitcoin’s finite supply and occasional rise on the back of geopolitical tensions has led to such comparisons.

Conversely the debate is relevant as both assets are ones which evoke a strong emotive reaction and raise similar questions about the state of the economy and the investment space. As bitcoin’s market cap increases (heading to $100 billion) it is inevitable that it will continue to grab the attention of the likes of Goldman Sachs and institutional investors. Most recently, Ray Dallio, the world’s biggest fund manager felt the need to point out the bitcoin bubble and how he favoured gold over the cryptocurrency.

Click here to read full story on GoldCore.com.

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Leave a Reply