I Thought I Was Middle Class

“The best way to teach your kids about taxes is by eating 30% of their ice cream.”– Bill Murray

When I saw that slimy tentacle of the Goldman Sachs vampire squid, Gary Cohn, bloviating about Trump’s tax plan and how it was going to do wonders for the middle class, I knew I was probably going to get screwed again. And after perusing the outline of their plan, it is certain I will be getting it up the ass once again from my beloved government.

I know everyone’s tax situation is different, but I’m just a hard working middle aged white man with two kids in college and some hefty family medical expenses. I’m already clobbered with Federal, State, City, and real estate taxes, along with huge toll taxes, sales taxes, gasoline taxes, utility taxes, phone taxes and probably a hundred more hidden taxes and fees.

I fucking hate taxes and want nothing more than to see them cut dramatically. I voted for Trump for the following reasons:

- He wasn’t that evil hateful shrew named Hillary Clinton

- He promised to repeal and replace Obamacare

- He promised to build the wall

- He promised to keep out Muslims

- He promised to reduce our military interventions around the world

- He promised to reduce my taxes

Well, one out of six ain’t bad. Right?

I know the Trump sycophants have a million reasons why he has been thwarted, but his pathetic support of the last GOP Obamacare lite bill reveals him to becoming just another establishment pawn. He has taken war mongering on behalf of the military industrial complex to a new level. No wall on the horizon. Now it is a figurative wall. And now he is disingenuously selling this tax bill as a huge windfall for the middle class, which is a lie based on my analysis of the known details. The truth is they need to screw the upper middle class in order to reduce corporate tax rates.

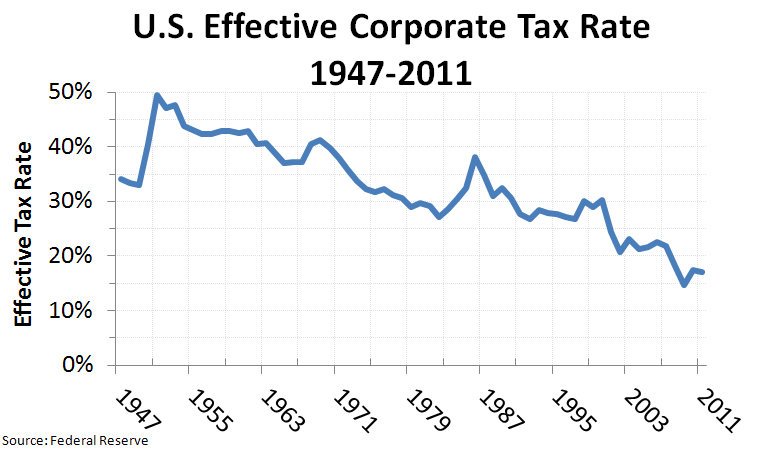

You hear the talking head “experts”, paid for by corporations, spinning a yarn about the 35% corporate tax rate and how it makes our corporations terribly disadvantaged. The truth is corporate lobbyists (I don’t have a white working man middle class lobbyist working for me) have bribed Congress to insert so many exemptions, deductions, credits, and loopholes into the tax code, the big corporations pay an effective tax rate of 19% already. If overly burdensome corporate taxes were really a problem, would corporations be generating record after-tax profits while GDP grows at a pitiful 2% rate?

I don’t know how many people are in my boat, but I’m guessing it is a large portion of the middle class. We already know about 50% of the households in the U.S. don’t pay any Federal Income Tax. Some even get refunds for not working. That’s why there are tax preparation offices all over West Philly and other urban welfare enclaves around the country. Here are the tax brackets for a married middle class family:

Most middle class families see the majority of their income taxed between the 10% and 15% rate, with upper middle class families having a portion taxed at 25%. A family with taxable income of $100,000 would have a tax bill of about $16,500, for an effective rate of 16.5%.

Trump’s plan has three rates: 12%, 25%, 35%. The weasels do not give the income level cut-offs. But we do know they are proposing elimination of the $4,050 personal exemption and the deduction for state and local taxes. They increase the standard deduction from $12,700 to $24,000. The idea is to keep people confused until the 2,000 page bill gets passed in the middle of the night after corporate lobbyists insert their goodies. In my situation, it is certain I will be getting screwed.

My family of four will lose $16,200 of personal exemptions versus gaining $11,300 in the standard deduction. Where I’m really getting screwed is losing the state and local tax deduction. The only single benefit to me working in this godforsaken hell hole called Philadelphia is I get to deduct the massive tax shakedown amount on my tax return. My PA, Phila, and real estate tax bill is huge. It’s far more than my mortgage deduction. And Trump is taking it away.

I’d be in favor of taking all deductions, exemptions, credits, and corporate loopholes away. But that’s not how it works. Corporations and Trump billionaire cronies will add loopholes and goodies into the bill, while people like me get fucked again. By replacing the 10% and 15% tax rate with 12% and 25%, the average middle class family will get screwed.

In the previous example of a family making $100,000, with a significant state and local tax deduction, the $16,500 annual tax bill will likely go up dramatically. Even if they taxed the first $50,000 (a big if) at 12%, their annual tax bill would go up to $18,500, a 12% increase. If that 12% bracket cutoff is lower, then the tax bill will soar. There isn’t a reasonable scenario where a home owning middle class family of four doesn’t pay more taxes under the Trump proposal.

Don’t believe what you hear on TV from paid for propagandists. You are going to get screwed so corporate fat cats can boost their profits even more. If they reinvest those profits, it will be in robots and technology to eliminate the jobs they haven’t shipped overseas. Oh. By the way, where are those tariffs against China, Mexico and the rest of the world to bring back our jobs? Trump is a phony and his tax plan sucks. Remember, up until 1913 citizens didn’t pay a dime in personal income taxes and the industrial revolution still happened and the country grew like a weed.

“One thing is clear: The Founding Fathers never intended a nation where citizens would pay nearly half of everything they earn to the government.” ― Ron Paul

Reprinted with permission from The Burning Platform.

The post I Thought I Was Middle Class appeared first on LewRockwell.

Leave a Reply