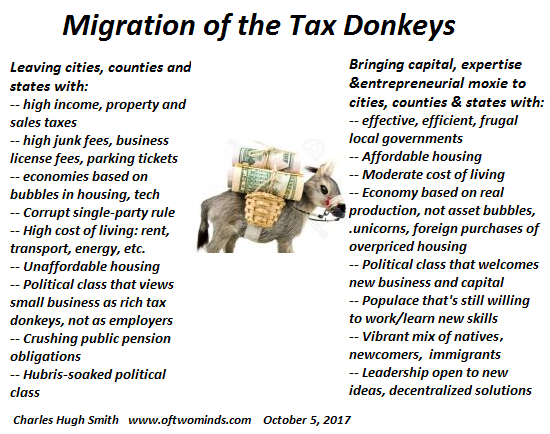

Migration of the Tax Donkeys

Dear local leadership: here’s the formula for long-term success.

A Great Migration of the Tax Donkeys is underway, still very much under the radar of the mainstream media and conventional economists. If you are confident no such migration of those who pay the bulk of the taxes could ever occur, please consider the long-term ramifications of these two articles:

Stanford Says Soaring Public Pension Costs Devastating Budgets For Education And Social Services

Which American Cities Will File Bankruptcy Next?

Allow me to summarize for those who aren’t too squeamish: a lot of cities and counties are going to go broke, slashing services and jacking up taxes, all to no avail. The promises made by corrupt politicos cannot possibly be kept, despite constant assurances to the contrary, and those expecting services and taxes to remain untouched will be shocked by the massive cuts in services and the equally massive tax increases that will be imposed in a misguided effort to “save” politically powerful constituencies and fiefdoms.

These dynamics will power a Great Migration of the Tax Donkeys from failing cities, counties and states to more frugal, well-managed and small business-friendly locales. I’ve sketched out the migration in this graphic: the move by those who can from incompetently managed and/or corrupt cities/counties/states to more innovative, open, frugal and better-managed locales.

Unlike Communist regimes which strictly control who has permission to transfer residency, Americans are still free to move about the nation. This creates a very Darwinian competition between sclerotic, corrupt, overpriced one-party-dictatorships whose hubris-soaked political class is convinced the insane housing prices, tech unicorns, abundant services, and a high-brow culture ruled by an artsy elite are irresistible to everyone, and locales that are low-cost, responsive to their Tax Donkey class, welcoming to new small businesses, employers and talent, unbeholden to a politically-correct dictatorship and conservatively managed, i.e. not headed for insolvency.

Not everyone can move. Many people find it essentially impossible to move due to family roots and obligations, poverty, secure employment, kids in school, and numerous other compelling reasons.

However, some people are able to move–typically the self-employed independent types who can no longer afford (or tolerate) anti-small-business, high-tax municipalities and their smug elitist leadership that’s more into virtue-signaling than creating jobs and a small-biz conducive ecosystem. (Giving lip-service to small-biz doesn’t count.)

Memo to hubris-soaked politicos and elites: in case you haven’t noticed, an increasing number of the most talented and experienced workers can live anywhere they please and submit their output digitally. In other words, they don’t have to live in Brooklyn, Santa Monica or San Francisco.

This is the model for many half-farmer, half-X refugees I’ve described elsewhere: people who are moving to homesteads with the networks and skills needed to earn a part-time living in the digital economy. In a lower cost area, they only need to earn a third or even a fourth of their former income to live a much more fulfilling and rewarding life.

The post Migration of the Tax Donkeys appeared first on LewRockwell.

Leave a Reply