Every Working American Owes $ 1.5 Million

The facts just don’t add up. US wages are falling, trade deficit is at 10 year high, debt is surging so are stocks and the US Government has again managed to publish a number of contradicting employment figures that make no sense whatsoever.

A CONFIDENT BUT UNEMPLOYED CONSUMER

US Consumer Sentiment is the highest in 13 years. At the same time US October Household Employment Survey dropped 484,000 and the Labour Force shrank by 765,000. But due to manipulation of the figures, October payroll increased by 261,000 and the Unemployment Rate declined to 4.0% from 4.2%. The Labour Participation Rate is down to the 1977 level with only 62% of the population employed or looking for work.

How can anyone believe any of these figures which tell us Payroll increased and Unemployment declined at the same time as Employment and Labour force went down substantially. It must all be pure fantasy.

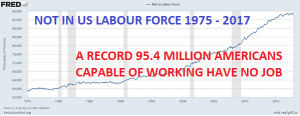

The Labour Participation rate is down from 67% in 1999 to 62% currently. The problem with the US labour statistics is that it conveniently disregards the 95.4 million people, a record level, who are able to work but are not working. The total US labour force capable of working is 256 million. Of those 161 million are actually working or actively looking for a job.

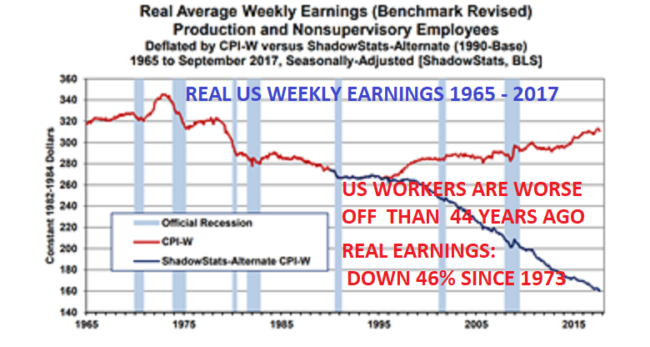

So the 95.4 million not working, many of which have given up looking for a job, represent 36% of the all those capable of working. So with fewer people working and with average workers’ real pay having declined since 1975, it is hard to understand that people in the US are feeling so optimistic.

THE CONFIDENT CONSUMER HAS STOPPED SHOPPING

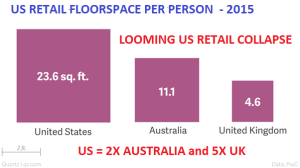

Having recently visited the US, it is difficult to understand that the US consumer is the most confident in 13 years. I visited a few shopping malls including a major mall in Boca Raton, Florida with all the major department store chains plus all the speciality chains. Boca is an affluent area but still, virtually all stores were dead with lots of staff who had nothing to do. There was only one store which was packed which was Apple. The Microsoft store was also totally empty. The state of US retailing is clearly dire with 5X as much retail space per person as in the UK, a country which is also over shopped. With 6,700 planned closures so far in 2017, this industry is clearly haemorrhaging.

Retail is hit by the decline in real disposable income and also the development of online sales. Although the Amazon valuation has looked ridiculous for many years, maybe it is justified as this company eventually will have a total monopoly in many areas of retail with the exception of some specialty chains such as non-branded fashion.

THE US IS CONTINUING TO LIVE ABOVE ITS MEANS

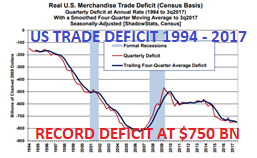

But the problem is not just retailing. The US Trade Deficit is continuing to balloon and is now at an annualised $750 billion which is the worst since 2007. Real construction spending is also declining and is the worst since 2011.

ALICE IN WONDERLAND FANTASY

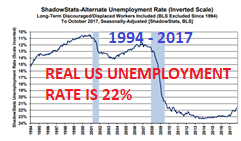

Either Americans are misled by the continuous bubble highs in stock markets or by the government propaganda which the media, without analysis, just publishes as fact although virtually all of it is Alice in Wonderland Fantasy. Or maybe the bullish Consumer Sentiment figures are just as fake as most of the figures produced by government. How else can the official unemployment figures be 4% when according to proper analysis by John Williams of Shadowstatistics, it is 22%.

As the British Prime Minister Disraeli stated: “There are Lies, Damned Lies and Statistics”. But markets love these lies since they continue to drive valuations exponentially higher whether it is the FAANG stocks or Cryptocurrencies.

EVERY WORKING AMERICAN OWES $1.5 MILLION

The US working population of 154 million have the responsibility for the US total debt which currently is $70 trillion. That excludes unfunded liabilities of anywhere from $120 trillion to $200 trillion which also must be funded.

But if we just take the $70 trillion debt, that amounts to $454,000 of debt for each person working. Adding the unfunded liabilities, we are looking at anywhere between $1.2 and $1.7 million debt per US working citizen. Since the average US person is one wage check from bankruptcy, he is hardly in a position to pay anywhere from $454,000 to $1.7 million on an average gross wage of less than $50,000. If every working American paid used his gross wage to pay off this debt, it would take over 50 years to pay off including interest and inflation. But the average American couldn’t even afford to allocate 10% of his wage to repay the debt and liabilities. Thus Americans couldn’t even afford a 500 year repayment plan.

But the US isn’t alone. Japan and many countries in Europe are in the same situation. Global debt can never be repaid. And when interest rates increase to 10%, 15%, 20% which is very likely, the financial system will implode.

The post Every Working American Owes $ 1.5 Million appeared first on LewRockwell.

Leave a Reply