German Investors Now World’s Largest Gold Buyers

– German gold demand surges from 17 ton-a-year to a 100 ton-plus per year

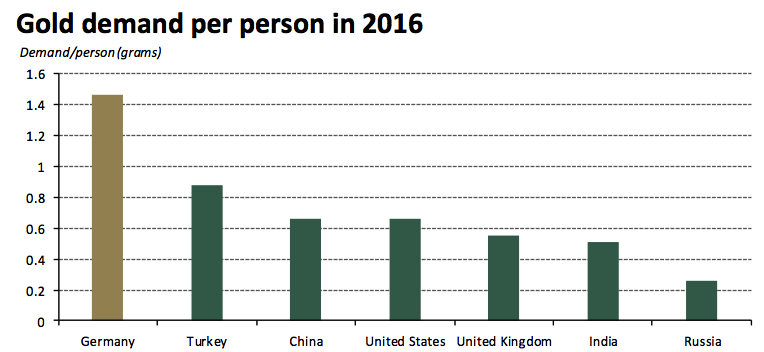

– €6.8 Bln spent on German gold investment products in 2016, more per person than India and China

– Germans turned to gold during financial crises and ongoing euro debasement

– Evidence of latent retail demand on increased economic concerns

– “Gold fulfils an important long-term, wealth preservation role in German investors’ portfolios”

Editor: Mark O’Byrne

India and China often grab the headlines as the world’s largest buyers of gold. In 2016 this was not the case.

When measured on a per capita basis it is Germany that takes the impressive crown of largest gold buyer in 2016, all thanks to their investment market. Last year the country set a new personal best, ploughing as much as £6.8bn ($8 bn) into gold coins, bars and exchange-traded commodities (ETCs).

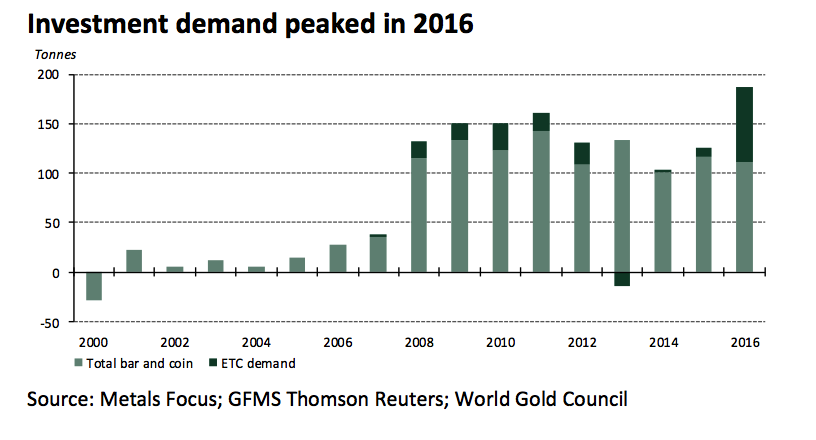

This is impressive considering that back in 2008 the amount of gold purchased by Germans barely registered outside of the country. A new World Gold Council report records that ‘average demand between 1995 and 2007 was a modest 17 tonnes’. In some of those years they weren’t even net-buyers.

In 2008 this began to change as ‘the global financial crisis brought gold to the attention of German investors at large.’ By 2009, the German gold investment market became one of the world’s largest, with annual coin and bar demand growing four-fold from 36t in 2007 to 134t in 2009.

Since then it has continued to climb, as explained in the latest World Gold Council report:

Germany has established itself as a 100t-plus per year market for bars and coins, and a vibrant domestic ETC market has developed: during Q3 2017, German-listed ETC AUM hit an all-time high of 252.1t, equivalent to €9.8bn.

So what changed and can the country keep up this record-breaking?

What changed?

It is assumed that the Germans have an innate understanding of the value of gold thanks to their tumultuous economic history.

As the WGC summarises:

German investors have an acute awareness of the wealth- eroding effects of financial instability. Hyper-inflation in the 1920s lingers on in the collective memory but, perhaps more importantly, German investors have seen fiat currencies come and go: in the past 100 years, Germany has had eight different currencies.

The past seemed to be catching up with the future following the financial crisis when savers once again began to see their savings disappear. Following the ECB’s decision to slash interest rates German banks began charging customers to hold their cash, and yields on German bunds dropped into negative territory.

It isn’t surprising that that this triggered Germany’s gold shopping spree. This was supported by the country’s growing gold bullion network that has made it easier for customers to buy and store gold bullion and coins.

Their concerns about the banking system drove up demand for the physical, allocated gold products of the 100-150 non-bank bullion dealers across the country. Investor behaviour shows that gold buyers are clearly seeking out physical gold that they can take delivery of should they so wish.

Where does it go from here?

‘…it is clear why the market boomed. Financial and economic crises brought gold to the attention of investors, and the resulting interest triggered a wave of product innovation and market development.’

Given the upshot in German demand following the financial crisis of 2008, it is understandable to look out for further economic downturns as an indication of future gold demand in Germany.

Click here to read full story on GoldCore.com.

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Leave a Reply