The Biggest Wealth Transfer in History

What will happen between now and 2025? Nobody knows of course but I will later in this article have a little peek into the next 4-8 years.

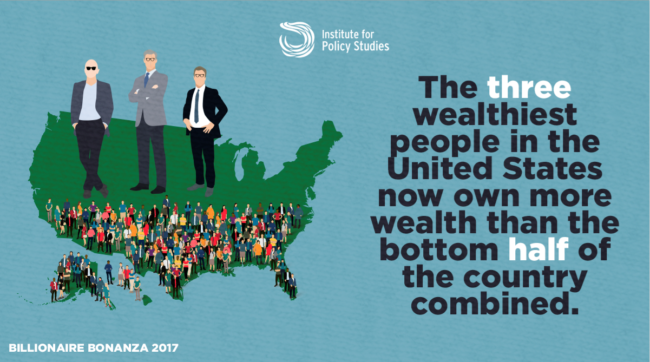

The concentration of wealth in the world has now reached dangerous proportions. The three richest people in the world have a greater wealth than the bottom 50%. The top 1% have a wealth of $33 trillion whilst the bottom 1% have a debt $196 billion.

The interesting point is not just that the rich are getting richer and the poor poorer. More interesting is to understand: How did we get there? and what will be the consequences?

Buy Silver at Discounted Prices

PANAMA & PARADISE PAPERS – SENSATIONALISM

As the socialist dominated media dig into the Panama Papers and now recently the Paradise Papers to attack the rich and tell governments to tackle the unacceptable face of capitalism, nobody understands the real reasons for this enormous concentration of wealth. Sadly no journalist does any serious analysis of any issue, whether it is fake economic figures or the state of the world economy.

Instead, all news is accepted as the truth while in fact a lot of news is fake or propaganda. The media is revelling in all the disclosures of offshore trusts and companies. The British Queen is being accused of having “hidden” funds. The fact that offshore entities have been used legally for centuries for privacy, wealth preservation and creditor protection purposes is never mentioned. The media sell more much news by being sensational rather than factual.

INEQUALITY IS DUE TO IRRESPONSIBLE MONETARY POLICY

Let me first put the facts right. It is not capitalism in its traditional sense which has created this enormous concentration. One definition of capitalism is:

“An economic and political system in which a country’s trade and industry are controlled by private owners for profit, rather than by the state”

The “controlled by private owners” part of the definition fits our current Western system. But what is missing is that the current economic system could not function without complete state sponsorship and interference. This is the clever construction that a group of top bankers devised on Jekyll Island in the US, in November 1910. This was the meeting that led to the creation of the Fed in 1913. The Central Bank of the US was set up as a private bank, and thus controlled by private bankers for their own benefit.

The bankers devised what one of their forefathers, Mayer Amshel Rothschild had preached:

From the bankers’ point of view, this was a brilliant idea. They now had total control of the money without having to risk more than a smaller part of their own capital. And the government found this system perfect for buying the people’s votes. By issuing more and more debt and allowing banks to leverage their balance sheets, the nation saw their standard of living increase significantly. More cars, televisions, holidays, iPhones etc. Little did the people realise that their improved standards were all at the expense of massive increases in government debt and personal debt.

US DEBT UP 1800X IN 100 YEARS

Total US debt in 1913 was $39 billion. Today it is $70 trillion, up 1,800X. But that only tells part of the story. There were virtually no unfunded liabilities in 1913. Today they are $130 trillion. So adding the $70 trillion debt to the unfunded liabilities gives a total liability of $200 trillion.

In 1913 US debt to GDP was 150%. Today, including unfunded liabilities, the figure becomes almost 1,000%. This is the burden that ordinary Americans are responsible for a burden that will break the US people and the US economy as well as the dollar.

Whilst ordinary people have been landed with liabilities that they can never repay, the bankers and the 1% elite has profitably (ab)used the leverage that the debt expansion has created and thus amassed massive fortunes.

That is why we are seeing this enormous inequality in wealth. Ordinary people have not yet realised that they are liable for this debt. They will of course never repay it, nor will anyone else. Governments will try to solve the problem by printing even more money, thus exacerbating the problem. Eventually this will lead to high inflation turning to hyperinflation with interest rates going to at least 15-20% but probably higher. At that point central banks have lost total control of their interest rate manipulation.

The world will then discover that this time the money printing will have no effect as manufactured money can never create wealth.

BIGGEST WEALTH TRANSFER IN HISTORY

The consequences of the implosion of debt and assets will lead to the biggest transfer of wealth in history. As debt implodes, so will all the bubble assets. Stocks, bonds and property will decline between 80% and 100%. This is difficult for most people to accept but just remember that the Dow declined by 90% between 1929 and 1932. And 2000 to 2002, the Nasdaq declined by 80%.

Neither of these examples involved a global debt situation or asset bubble that we are in now. This time the world must unwind $2 quadrillion of debt, unfunded liabilities and derivatives. That is 29X global GDP of $70 trillion and therefore of a magnitude that will lead to a collapse of the financial system.

The post The Biggest Wealth Transfer in History appeared first on LewRockwell.

Leave a Reply