Bubble Finance

Today’s single most dangerous Wall Street meme is that there is no risk of a stock market crash because there is no recession in sight. But that proposition is dead wrong because it’s a relic of your grandfather’s economy. That is, a reasonably functioning capitalist order in which the stock market priced-out company earnings and the underlying macroeconomic substrate from which they arose.

Back then, Economy drove Finance: You therefore needed a main street contraction to trigger tumbling profits, which, in turn, caused Wall Street to mark-down the NPV (net present value) of future company earnings streams and the stock prices which embodied them.

No longer. After three decades of monetary central planning and heavy-handed falsification of financial asset prices, causation has been reversed.

Finance now drives Economy: Recessions happen when central bank fostered financial bubbles reach an asymptotic peak and then crash under their own weight, triggering desperate restructuring actions in the corporate C-suites designed to prop up stock prices and preserve the collapsing value of executive stock options.

Accordingly, you can’t see a recession coming on Janet Yellen’s dashboard of 19 labor market indicators or any of the other “incoming” macroeconomic data—industrial production, retail sales, housing starts, business investment—- so assiduously tracked by Wall Street economists.

Instead, recessions gestate in the Wall Street gambling parlors and become latent in carry trades, yield curve and credit arbitrages and momentum driven excesses. Eventually, these latencies—central bank fostered bubbles—–erupt suddenly and violently. So doing, they spew intense, unexpected contractionary impulses into the main street economy via the transmission channel of C-suite “restructuring” actions.

Within weeks of a bubble implosion, therefore, a No-See-Um Recession is born and goes rampaging across the economic landscape. But it comes as a shock to economists and especially the Keynesian apparatchiks at the Fed because they are focused on the macroeconomic externals rather than the coiled spring internals of the financial markets.

In this context, it can be said that the Great Recession was the first major business cycle contraction that reflected the new regime of central bank driven Bubble Finance.

What happened was that a garden-variety macroeconomic slowdown which incepted in 2007 went rogue when it was monkey-hammered by the Lehman bankruptcy and the related crash of fundamentally insolvent Wall Street gambling houses thereafter.

This is evident in much of the macroeconomic data, but the snapshot of retail sales below aptly illustrates the case.

From July 2006 through August 2008 (the ninth orange bar in the shaded area) the US economy oscillated along a flatline of weak and inconsistent retail sales growth. Although in its wisdom the NBER dated the recession as incepting in December 2007, the retail sales pattern during the first nine months of the downturn was not appreciably different than during the 17 months just prior.

But in September 2008 retail sales went into free fall—-coterminous with the Wall Street meltdown and the desperate Washington interventions via the massive Fed liquidity injections and the TARP bailout. During that month, retail sales plunged at a 21% annualized rate—–followed by 50%annualized rates of collapse in November and December and nearly a 30% rate of shrinkage in January 2009.

As demonstrated more fully below, those four months were ground zero of the Great Recession. They constituted a macroeconomic air pocket ignited by panic on Wall Street and in the corporate C-suites—exacerbated by the frenzied sky-is-falling machinations of Treasury Secretary Paulson and Ben Bernanke.

Stated differently, the violently collapsing Greenspan mortgage, credit and Wall Street gambling bubbles triggered four to eight months of macroeconomic freefall that no one saw coming. As late as July, the Fed minutes denied that a significant downturn was even likely in 2008, while the Wall Street stock peddlers were insisting that the goldilocks economy was alive and well.

The clueless Keynesian monetary central planners in the Eccles Building had thus fostered the first big No-See-Um Recession, but remained ignorant as to why it suddenly happened; and, consequently, doubled down on Bubble Finance policies that were destined to generate a future replay of the same.

Needless to say, that’s where we are now. The Wall Street casino has again become a coiled spring of excesses, deformations and unsustainabilities—that is, recession latencies waiting to burst.

For instance, there is no other way to describe current razor thin credit spreads in the junk and investment grade sectors alike. Central bank financial repression has fostered a relentless scramble for yield among fund managers that has caused the high yield spread to contract by more than 700 basis points from its post-recession high.

Likewise, the investment grade BBB spread at 1.32% now stands at just 29% of its June 2009 level. And since then the massive explosion of investment grade corporate debt has been concentrated in the BBB tranche of the bond market (one notch above junk), where it now comprises 50% of outstandings compared to just 25% a decade ago.

Needless to say, cheap high yield and BBB debt has had but a single major application since the post-recession recovery of the corporate bond market. To wit, it has funded trillions of financial engineering deals in the form of LBOs and levered recaps in the junk sector and massive stock purchases and dividends in the BBB sector.

So doing, these Fed-fueled financial engineering flows back into the casino have functioned to shrink the stock float and balloon the supply of speculative capital on Wall Street. At length, stock bubbles get aggravated and recession latencies intensified.

When the bond bubble finally implodes, of course, the overwhelmingly largest stock purchaser of the present bubble cycle—LBO shops and financial engineering addicted C-suites—will be forced to the sidelines. The coiled spring of financial engineering will thereupon unwind violently, triggering the next No-See-Um Recession.

And it will be self-reinforcing in a manner that is obvious, but to which the nation’s monetary central planners remain completely oblivious. That is, they continue to pronounce the “all clear” on financial instabilities and signs of incipient financial bubbles based on the alleged improved condition of bank balance sheets—especially the dozen largest mega-banks which account for 80% of deposits.

But the coiled spring this time is not in the mega-banks, but in the trillions of fixed income and high yield mutual funds and ETFs which have arisen to absorb the massive flow of corporate debt. And their liabilities are the ultimate “demand deposit”, callable by investors on a moments notice and at the hint of a financial crash.

Nor is the $6.1 trillion corporate bond sector—double the $3.3 trillion outstanding in late 2007—-the only coiled spring of recession latency lurking on Wall Street. The massive expansion of the ETF market since 2007 is probably even more potent as a bubble crash accelerant and therefore ignition channel for the coming No-See-Um Recession.

Outstandings have increased by 10X in the last decade and at more than $5 trillion are 3.3X the level extant on the eve of the financial crisis. Yet in the context of a dramatic market break—whether triggered by a black, orange or red swan—they will function as pure downside accelerants as fund managers are forced to dump their holdings in order to buy-in and liquidate the torrent of ETF shares which will be on offer.

Then, too, the violent break in September 2008 occurred long before the massive “short vol” play of the present moment had metastasized in the trading pits. Yet today an estimated $1 trillion is invested in risk parity funds, double and triple inverse VIX ETFs and a menagerie of bespoke vol shorts concocted by Wall Street for its hedge fund customers.

Indeed, the current massive short vol trade is the ultimate coiled spring that will aggravate and accelerate the next bubble collapse, and thereby function as the mother of all recession latencies. Yet we are quite certain that our bubble blowing monetary central planners have given no consideration at all to this ticking time-bomb—even as they gum endlessly over the meaning of hairline noise in the BLS’ latest (and useless) JOLTS report.

In this context, we do not profess to know the catalyst for the next bubble implosion, but we can readily identify the speed with which the post-Lehman collapse occurred in the stock market, and the manner in which that triggered massive restructuring actions, inventory liquidations and sweeping job cuts by the corporate C-suites.

What we do know, however, is that the financial market internals and their coiled springs of recession latencies are far more widespread and combustible than last time around. So it is worth specifying in more granular detail the recession transmission channel that operated through the corporate C-suites during the on-set of the Great Recession. The fall-winter dislocation of 2008-2009, in fact, is a roadmap for what comes next.

The S&P chart below is indexed to 100 as of September 1, 2008 and represents the eve of the Wall Street meltdown. By October 10, the S&P index was down 30% and by November 20 it closed at58.7% of its September 1 level.

So in roughly 50 trading days the broad market lost 41% of its capitalization.

Again, that was the heart of the bubble implosion. Thereafter the market gyrated along the flatline until it hit a one-day capitulation low on March 9 at a 47% loss. So fully 90% of the capitulation low occurred during the first 50 days, and it was the speed and violence of this bubble collapse that triggered what amounted to mayhem in the C-suites.

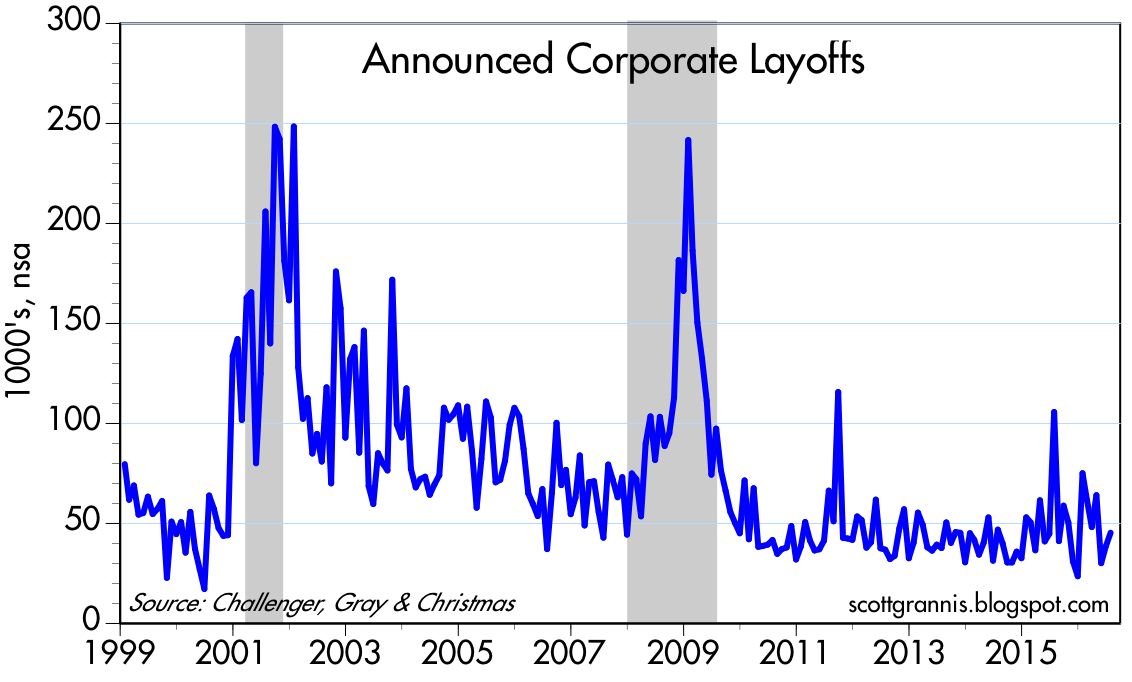

Needless to say, the response of the corporate C-suites was swift and violent. The Challenger survey of monthly corporate layoff announcements accordingly surged during the 4-6 months that the stock market was establishing a bottom 50% below the November 2007 bubble peak.

But as will be further documented below from the BLS payroll employment data, this spree of excess payroll liquidations occurred in a very concentrated pulse and then reverted to low order clean-up until hiring growth resumed about a year after the stock market crash.

Another measure of C-suite liquidation activity is represented by corporate restructuring charges. The latter not only capture severance expense associated with job terminations but also plant and store closures, charge-offs for bad debts and excess/obsolete inventories and numerous other categories of asset write-downs.

But it all shows up on the true bottom line—GAAP net income—which plunged to negative $15 per S&P 500 share in Q4 2008.

As shown below, that represented a negative $34 per share swing from the level of Q4 2007 and more than a 40% drop from Q4 2006. Still, the housecleaning was relatively short lived and confined to the period of maximum C-suite panic over company stock prices and option values.

The panic in the C-suites was aggravated substantially by a household sector buying strike—-especially on high price tag durables and automobiles.

In fact, the drop in auto sales was spectacular: After drifting steadily lower earlier in the year, dealer sales took a further sharp plunge after August 2008. Altogether, the dollar value of sales off the dealer lots contracted by a stunning 33% before hitting bottom in March 2009.

Needless to say, the above plunge of dealer sales occurred at a time when their lots were already bulging with excess vehicle inventory. Accordingly, the production cut back at domestic assembly plants was downright brutal—-with the seasonally adjusted assembly rate dropping from 9.1 million units in July 2008 to just 3.6 million units at the January 2009 bottom.

Indeed, that staggering 60% drop in six months—–which also sent GM and Chrysler into Chapter 11—represented anything but your grandfather’s economy. This was a collapsing Wall Street bubble ripping through the main street economy with malice aforethought.

The recession transmission channel through the C-suite liquidation process is starkly evident in the business inventory data and the BLS data on payroll employment change. As to the former, the chart below makes clear that business inventories had continued to build through the spring and summer of 2008, reaching a peak level of $1.54 trillion in July.

Eventually, $225 billion of that inventory (15%) was liquidated before restocking commenced in November 2009, but the key point is that more than 60% of the destocking occurred during the concentrated period of stock market collapse between September and March. The C-suite was desperately attempting to lighten the load.

Finally, the payroll data surely leaves nothing to the imagination. Nearly 5.5 million jobs were liquidated during eight months stretching from September 2008 through April 2009. That represented nearly 65% of all job losses during the entire Great Recession.

Stated differently, desperate to appease the Wall Street casino via “restructuring” actions to increase ex-items earnings, corporate America essentially embarked on a scorched earth policy of shooting jobs first and asking questions later.

In short, there can be little doubt that Finance drives Economy in the world of monetary central planning, and that the only place to look for the next recession is in the coiled springs of Bubble Finance.

Needless to say, you can once again find them metastasizing rapidly from one end of the casino to the other; and you will also find not a single word about them in today’s swan song by our Keynesian School Marm.

Then again, Janet Yellen’s cluelessness is also why Wall Street is telling you that the macroeconomic dashboard shows nary a sign of recession, and that its safe to plunge into the casino at 110X the Russell 2000 and 280X AMZN’s miserly earnings.

Call that misdirection like never before. But also know that another No-See-Um Recession is coming right at you.

Reprinted with permission from David Stockman’s Contra Corner.

The post Bubble Finance appeared first on LewRockwell.

Leave a Reply