Debt, Taxes, Growth

During more than four decades in Washington and on Wall Street it is quite possible that we never picked up any useful skills. But along the way we did unavoidably acquire what amounts to a survival tool in those fair precincts—-namely, a nose for the con job.

And what a doozy we have going now as a desperate mob of Capitol Hill Republicans attempts to enact something—anything— that can be vaguely labeled tax reform/tax cut. And for a reason that lies only slightly below the surface.

In a word, they are scared to death that the political train wreck in the Oval Office will put them out of business for years to come. So they are attempting to erect a shield of legislative accomplishment that can be sold in 2018 as the work of the GOP Congress, not the unhinged tweet-storm in the White House.

To be sure, some element of political calculus always lies behind legislation. For instance, the Dems didn’t pass the Wagner Act in 1935, the Voting Rights Act of 1965 or the Affordable Care Act of 2010 as an exercise in pure civic virtue—-these measures targeted huge constituencies with tens of millions of votes at stake.

Still, threadbare theories and untoward effects are just that; they can’t be redeemed by the risible claim that this legislative Rube Goldberg Contraption is being jammed through sight unseen (in ACA redux fashion) for the benefit of the rank and file Republican voters—and most especially not for the dispossessed independents and Dems of Flyover America who voted for Trump out of protest against the failing status quo.

To the contrary. The GOP tax bill is of the lobbies, by the PACs and for the money. Period.

There is no higher purpose or even nugget of conservative economic principle to it. The battle cry of “pro-growth tax cuts” is just a warmed over 35 year-old mantra from the Reagan era that does not remotely reflect the actual content of the bill or disguise what it really is: Namely, a cowardly infliction of more than $2 trillion of debt on future American taxpayers in order to fund tax relief today for the GOP’s K-Street and Wall Street paymasters.

On a net basis, in fact, fully 97% of the $1.412 trillion revenue loss in the Senate Committee bill over the next decade is attributable to the $1.369 trillion cost of cutting the corporate rate from 35% to 20% (and repeal of the related AMT). All the rest of the massive bill is just a monumental zero-sum pot stirring operation.

For instance, the new $2000 child credit will cost $584 billion over the decade (nearly $700 billion with the Rubio amendment to give rebates to taxpayers who don’t owe anything!).

But that is offset by the $1.22 trillion gain from repealing the current $4,050 personal exemption; the $134 billion gain from short-sheeting the indexing mechanism that protects taxpayers from inflationary bracket creep; and the $978 billion gain from eliminating the SALT (state and local taxes) deduction along with some other minor loopholes such as interest on home equity lines, non-disaster casualty losses and tax preparation expenses.

Then again, going in the other direction the bill will cost $737 billion owing to doubling the standard deduction to $24,000 per household and will further deplete Uncle Sam’s revenue collections by $1.17 trillion via rejiggering the current seven rate brackets.

But when all the zigging and zagging is done on the personal income tax side, what you get over 2018-2027 is a $1.20 trillion net reduction in personal income taxes.

But $83 billion of that goes to the estates of 5,500 dead people per year owing to doubling the estate deduction to $20 million per couple; and another $769 billion goes to about 5 million wealthy taxpayers (3.5% of filers) who are assessed the Alternative Minimum Tax (AMT) .

The latter is designed to catch taxpayers with unusually heavy use of tax deductions, exemptions and deferrals such as depreciation on personal property and real estate.

In the one year for which the Donald’s tax returns that have been leaked, for example, he paid $38 million in Federal income tax. But $31 million of that was snagged by the AMT owing to his obvious heavy use of deductions for depreciation and local taxes on property and real estate income.

We happen to agree that the AMT is a tax code monstrosity that should be repealed forthwith—having been afflicted by it ourselves. But we are also quite certain that it has nothing to do with supply-side incentives and economic growth and jobs.

No one who pays the AMT is going to work any harder or invest any more capital on account of its long overdue repeal. In fact, they actually will hire fewer people and pay lower wages and salaries—-that is, AMT payers will fire the legions of tax attorneys, accountants and consultants they employ to cope with it.

So aside from dead people and rich people, what you have left is a tiny $352 billion tax cut for the balance of 145 million tax filers over the entire next decade.

That computes to just 1.7% of CBO’s baseline revenue estimate of $21.1 trillion for the individual income tax (excluding AMT) collections over 2018-2027; and even that is written in disappearing ink, as the entire individual income tax section of the bill sunsets after 2025—save for the $32 billion per year tax increase owing to short-sheeting the inflation index.

But as they say on late night TV: Wait—there’s more!

To wit, fully 102% of this tiny $352 billion cut (i.e. more than all of it) is accounted for by the Senate’s small business “pass-thru” provisions, which allows 17% of eligible business income to be deducted at a cost of $362 billion over the period.

Again, we have no objection to cutting taxes on the unincorporated small businesses and entrepreneurs who create most of the nation’s new jobs. The fact remains, however, that the overwhelming share of the benefit from this provision will not go to the enterprising homemaker who hit the jackpot selling especially tasty cupcakes over the internet—nor any of the other earnest small business people being featured in the K-Street ads pumping the bill on TV.

In fact, more than half of “pass thru” business income is earned by the top 1%. And given that they would ordinarily be in the Senate bill’s new 38.5% bracket, they will get upwards of 80% of the estimated $362 billion of tax savings from this new deduction.

So there you have it. When you peel the onion back just a few layers on the individual side what you get is a giant pool of approximately 145 million taxpayers (excluding the top 1% and AMT payers) who in the aggregate will get tax relief of zip, zero, nichts and nada, too!

To be sure, there will be a lot of random careening shots within the total pool of individual income taxpayers. The Tax Policy Center’s distributional analysis, for instance, shows that in 2025 (the year before sunset), taxpayers in the middle quintile (incomes of $53,000 to $92,000) will get an average “cut” totaling the grand sum of $16.92 per week—-or enough to go to Starbucks every other day for a cappuccino and banana.

But inside that pool of about 30 million tax filers, 85% will actually get a cut of $24 per week, while the other 15% will experience a tax increase of $23 per week. Still, for the pool as a whole—-which is the heart of the middle class—-the total cut will amount to a mere 1.2% gain in after-tax income.

Technically, you might call that a “tax cut” because it does involve a tiny minus sign. But it is also undoubtedly the smallest, not the biggest, individual tax cut in history; and given the facts essayed above, it will not move the needle one single bit when it comes to the issue of growth, jobs and revenue reflows.

Stated differently, save for the business income tax cuts for corporate and pass-thru entities the Senate bill’s Laffer Curve is as flat as the restaurant table it was purportedly drawn on: You positively do not get an incentive effect from NOT cutting taxes!

So that gets us to the bill’s $1.7 trillion of business rate cuts—of which nearly 80% is due to cutting the corporate rate to 20%.

On the tax policy point, we wish to be very clear. The corporate income tax is a dysfunctional, obsolete relic that generates comparative meager Federal revenues ($324 billion or 9% of the $3.69 trillion revenue base in 2018)—-even as it fosters monumental and costly tax avoidance shenanigans in corporate America and heavy, costly but futile enforcement efforts at the IRS.

So call it a $3.9 trillion tax policy blight and nuisance over the next decade that should indeed be fixed. But a nation heading into a demographic twilight era with $31 trillion of public debt already built in by 2027, and saddled with a sputtering economy to boot, cannot prudently fix a nuisance by massive borrowing to get rid of it.

The right thing to do would be to cut Uncle Sam’s $53 trillion spending baseline over the next decade by the 7.5% that would be need to offset the revenue loss from repealing the corporate income tax; or better still, replacing it with a VAT or other consumption tax—- since trillions of spending cuts will be needed anyway to prevent the structural deficit from exploding later in the next decade.

In short, eliminating some or all of the corporate income tax with a “payfor” w0uld be a constructive endeavor. But borrowing $1.37 trillion to cut the rate to 20% under the nation’s current dire fiscal circumstances is an act of sheer madness; and to pretend that it will pay for itself in whole or part is one of the greatest con jobs every perpetrated in the Imperial City.

The fact is, in today’s central bank falsified financial system, corporate executives and other decision makers do not operate on anything which resembles the Laffer Curve, wherein a lower rate of tax ostensibly incentivizes a higher rate of output and the revenue flow-back therefrom.

The overwhelming reason for that proposition is that the central banks have made debt and equity capital dirt cheap and almost infinitely abundant. For instance, the average after-tax cost of debt capital carried by the big US corporations today is 2% or even less, and the earnings yield on equity capital for the S&P 500 is hardly 4%.

In all of modern history, there has never been lower return on capital barriers to business investment and output expansion.

Indeed, if the corporate income tax were responsible for recent tepid economic growth, as GOP politicians loudly declaim, then the chart below couldn’t exist. The path of the red line (3-year rolling GDP growth) and the blue line (effective corporate tax rate) are plain and simply a smoking gun.

In a word, the effective corporate tax rate, which is what companies actually pay after all of their tax planning and avoidance maneuvers, has dropped from 50% during the Korean War era to hardly 22%today; and aside from recession caused fluctuations, the trend (dotted blue line) has been steady downward for more than a half century.

And so has the dotted red line—-the trend rate of GDP growth. And that parallel path is fundamental to the GOP tax con job.

If there is no evidence that the corporate tax has accounted for the sinking trend of economic growth—especially since the late 1980s—-then it cannot logically be expected that a reduction of the statutory rate will generate the opposite; and as we show tommorrow, it would take a tsunami of extra growth to pay for the corporate rate reduction.

That’s especially the case because all of the propaganda in favor of the big corporate tax cut is essentially a Keynesian argument based on enhanced after-tax cash flow to corporate treasuries, not the marginal rate incentive effect from supply side theory.

For instance, IBM most recently reported an effective tax rate of 11%, which is a far cry from the statutory rate. We have no idea what it would do with its winnings from the Senate bill, if any (we suspect it would buyback more stock on top of the $100 billion it has purchased in the last decade).

But clearly its calculus would start from 11%, not 35%. Not a single decision-maker in Armonk has thought about the statutory tax rate for decades, let alone made an investment decision based upon it.

The problem on that score is that as the GOP tax writers struggled with a limited $1.5 trillion deficit envelope they perforce needed to broaden the business tax base in order to reduce the net cost of the rate cuts.

On the pass-thru side, for example, the Senate bill effectively lowers the rate on qualifying business income to 31% via the 17% deduction. But the $362 billion cost is partially offset by a $137 billion 10-year increase in revenue due to a new provision that would drastically curtail the ability of essentially the same taxpayers to deduct active losses in excess of $500,000.

So the net tax cut on pass-thru businesses is actually just $225 billion.

Likewise, the corporate rate cut costing $1.36 trillion is offset by base broadeners and loophole closers totaling $690 billion over the period. Foremost among these is a limit on interest deductions to 30% of adjusted taxable income, which alone is estimated to raise $308 billion over 10-years.

So on an after-tax cash flow basis, the viewpoint of advocates, the net tax cut on corporate income would amount to $682 billion or just half of the pure rate cut (and AMT) provisions in the Senate Committee bill. And for all US businesses— including pass-thrus—-the net tax savings over the decade is $907 billion.

To be sure, we don’t think that’s chopped liver, but it’s actually a big number that must be compared to a far bigger one. To wit, the CBO baseline for total domestic business pretax profits (corporate and pass-thru) is $18.2 trillion over the period.

Accordingly, the net gain in after tax cash flow embedded in the Senate bill amounts to just 5% of profits. Even if American businesses were starved for capital—-which is hardly the case—such a modest release of pre-tax earnings is hardly going to incite a tsunami of investment, output, jobs, wages and tax revenues.

In fact, however, we think the overwhelming share of this 5% gain in after-tax cash flow will go to owners and shareholders in the form of dividends, stock buybacks and other forms of capital return, including LBOs.

There is absolutely nothing wrong, of course, with business owners and equity investors getting bigger returns and more money in their bank accounts. That is, so long as Uncle Sam doesn’t borrow the money to make it happen—-exactly as does the Senate tax bill.

In this context, we offer two charts which we think nail the case that nearly all of the net $900 billion of business cuts will end up flowing to the top 1% and 10% who own most of the business equity in the US.

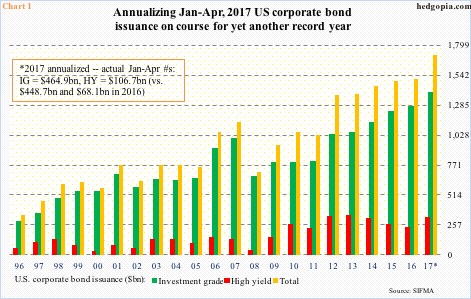

On the one hand, US business has been borrowing in the bond markets like there is no tomorrow. It appears that total corporate issuance this year will hit nearly $1.8 trillion, which is triple the turn of the century level, and nearly 165% of the pre-crisis borrowing peak in 2007.

There flat-out is no scarcity of capital or economic barrier to corporate investment in the US.

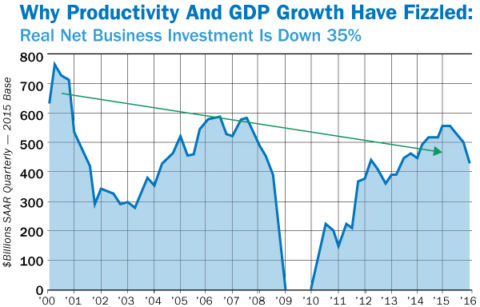

At the same time, net investment in real plant, equipment and technology is still 35% lower than it was at the turn of the century. Funding has exploded, but investment in real productive assets—after allowing for current year depreciation on the existing stock— has effectively imploded.

There is no mystery, however, as to where all the borrowed cash went—to say nothing of the trillions of internally generated business cash flow. To wit, it went into $15 trillion of financial engineering—stock buybacks, M&A deals, unearned dividends and LBOs—-over the last decade.

We have demonstrated ad nauseum that the Fed’s Bubble Finance regime has turned the C-suites of corporate America into financial engineering joints and stock market speculation arenas. The data for stock buybacks alone is dispositive.

Recall that in honest free market capitalism the purpose of equity markets first and foremost is to raise new capital; and the purpose of trading on the secondary market is to create liquidity for existing stocks and to provide a forum for honest price discovery.

The chart below belies that presumption completely. Wall Street runs a continuous movable feast of equity liquidation, not new capital raising.

US corporations have been incentivized by essentially one-way, central bank supported casinos— which masquerade as stock markets—-to convert their cash flows and balance sheets into massive stock purchases.

Give US companies an additional $900 billion over the next decade and the main result will simply be even longer blue bars in the chart above.

Nevertheless, tax bill advocates keep arguing that notwithstanding the overwhelming evidence above, that US business would invest more at home if the business income tax rate were lowered relative to those abroad. That is to say, capital has never been cheaper at home, but purportedly it is even cheaper on an after-tax basis abroad.

That’s exactly what 100 prominent conservative economists recently argued in the flowing missive:

In today’s globalized economy, capital is mobile in its pursuit of lower tax jurisdictions. Yet, in that worldwide race for job-creating investment, America is not economically competitive. Here’s why: Left virtually untouched for the last 31 years, our chart-topping corporate tax rate is the highest in the industrialized world and a full fifteen percentage points above the OECD average. As a result of forfeiting our competitive edge, we forfeited 4,700 companies from 2004 to 2016 to cheaper shores abroad. As a result of sitting idly by while the rest of the world took steps to lower their corporate rates, we lowered our own workers’ wages by thousands of dollars a year.

We will complete our debunking of the GOP tax con tomorrow, but for the moment consider the case of the world’s single greatest company—-Apple Inc. It starkly illustrates why the above claim that 4,700 companies have moved production abroad owing to high tax rates is just plain nonsense.

For purposes of simplification, Apple has a product sourcing department and a tax planning department. The former has moved production and jobs abroad for economic reasons that will not change owing to the GOP tax bill; and the latter department has moved the company’s tax books to low rate havens in Ireland and elsewhere for, well, tax avoidance reasons.

Since Apple’s effective tax rate owing to the aggressive and creative work of its tax planning department is already about 20%, the new GOP tax regime will have little effect except to extract a one-time 5% levy from the $185 billion of notional cash that Apple has stashed in off-shore tax books (actually most of the actual cash is in New York and other US based banks). The whole thing is a pure paper chase.

On the other hand, Apple’s sourcing department contracted-out virtually all of its massive gadget production to Foxconn, which produces exclusively in China and employs upwards of 1.1 million workers. And the reason for that is labor rates which are perhaps 10% of the fully loaded cost (including payroll taxes and fringe benefits) of producing iPhones and iPads in California, Arizona or Wisconsin.

Needless to say, the Senate will not change this massive labor cost gap, either. Apple will only bring jobs back to the US if some state government is foolish enough to pay them a giant subsidy to close the gap.

In short, US companies have off-shored their tax books because they can. Thanks to favorable tax rulings over the years this has been made all the easier by blatant but legal sheltering devices—-such as having an Irish subsidiary own the technology patents and charge the US tax entity a stiff royalty for using them.

But as we will show tomorrow, Apple is no outlier. The overwhelming share of production and jobs which have been off-shored—such as IBM’s 130,000 workers in India—have happened for economic reasons which far outweigh any impact of the statutory tax rate.

At the end of the day, the GOP tax bill boils down to borrowing more than $1 trillion from the American public in order to pay higher dividends to wealthy private stockholders.

And that’s a real con job.

Reprinted with permission from David Stockman’s Contra Corner.

The post Debt, Taxes, Growth appeared first on LewRockwell.

Leave a Reply