Below is an excerpt from the report’s introduction, “The United States Can Stop Killing and Dying, and Start Building Again.” An electronic version of the report will be available soon.

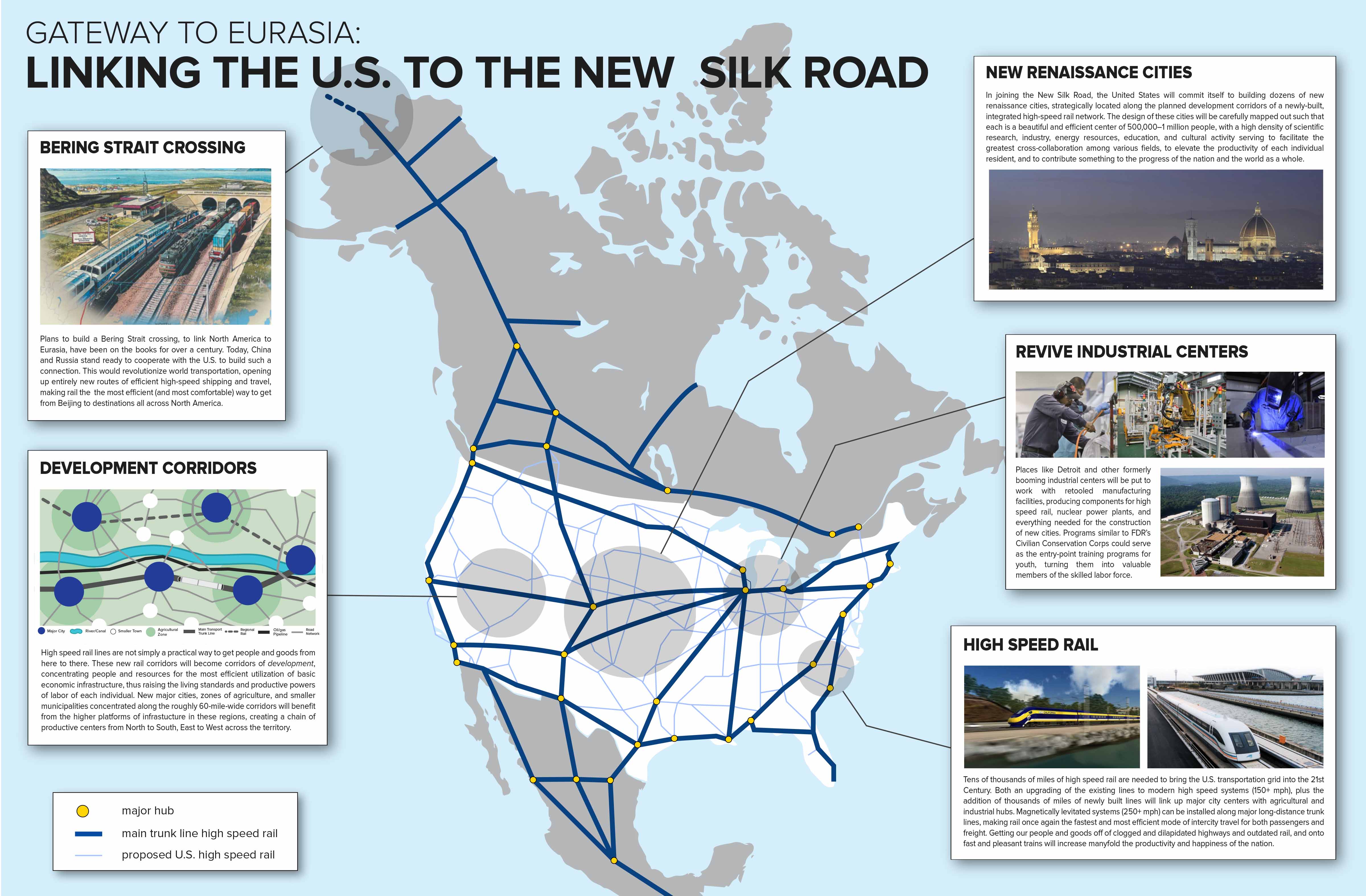

We must build the future—we must build tens of thousands of miles of high-speed rail corridors; nuclear power development leading into the era of fusion; the construction of hundreds of new Renaissance cities across the country; controlling rainfall based on insights gained from the Galaxy; space exploration and research; and so on. And all of this must be done in tight coordination with the BRICS and allied nations, led by China and Russia, who are already engaged in such a process of building a New Silk Road, and turning it into the World Land-Bridge.

The United States has to join this effort, not only in its international dimension, but also to extend it into the U.S. itself, both economically and culturally. It is the only way to create a future for our youth, to give them back a sense of hope and mission which is their birthright.

The New Silk Road, the inland and maritime corridors of infrastructure development being built across Eurasia, offers a reversal of the collapse now underway. The international development banks which have been formed by the BRICS nations are potential new sources of credit for serious, modern infrastructure building in North America, for the first time in half a century. A highspeed rail corridor coming across the Bering Strait by tunnel and down through Alaska and Canada into the Western United States, and beyond into Central and South America, offers America’s first connection to the New Silk Road pioneered by China. A new United States National Bank which Congress can organize for productive projects, will provide America’s connection to the new international credit institutions, which will issue credit for development and banish the hated austerity conditionalities which are the hallmark of the IMF system.

But many Americans are so deeply infected with the bacillus of pessimism and despair, that they will respond to such an optimistic vision of the future with a shrug: “Yeah, yeah. That’s nice. But it’ll never happen. It can’t be done. Get real.”

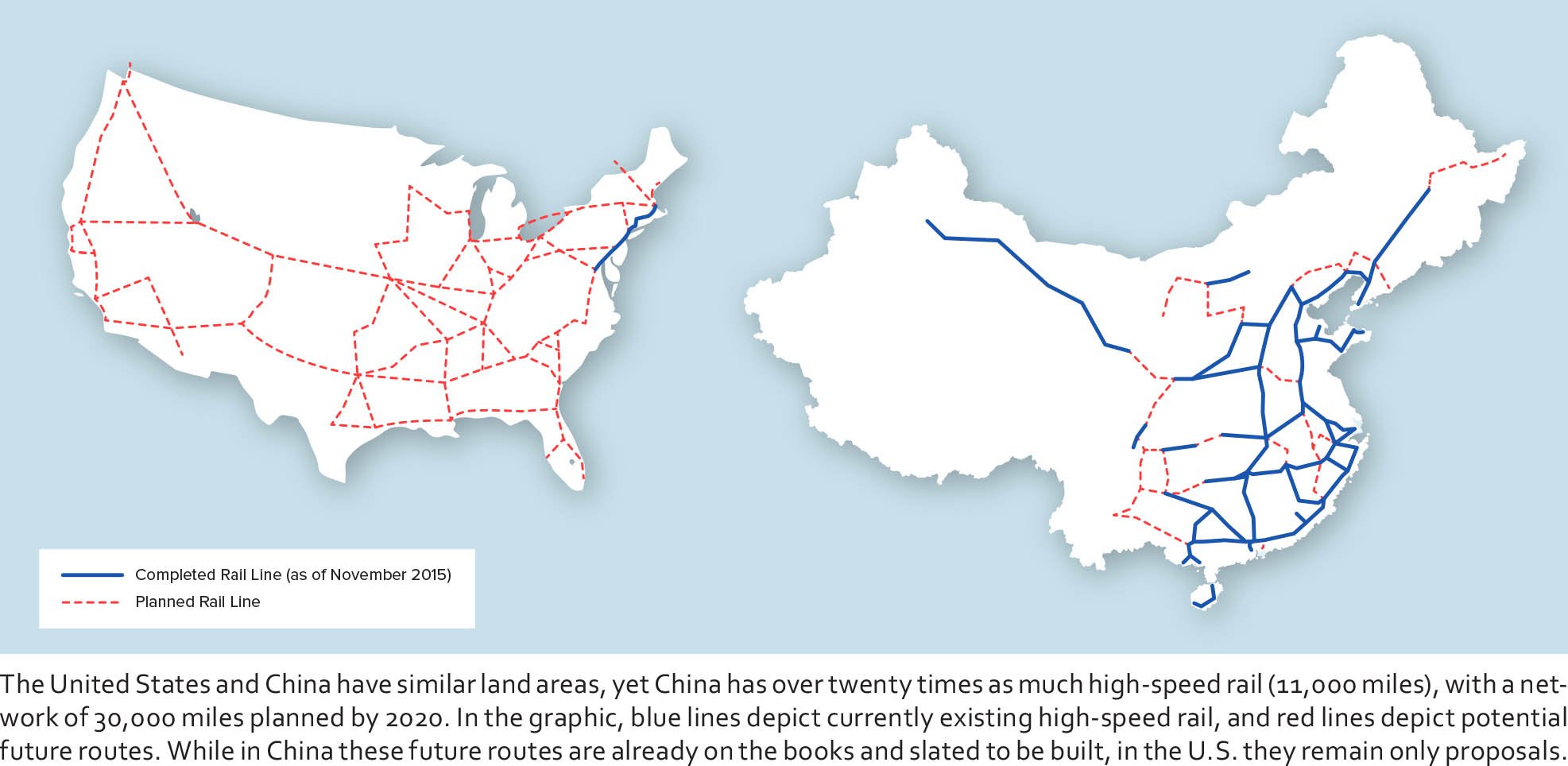

Very well. Here’s real: China has lifted 600 million people out of poverty over the last 30 years. They have built 11,000 miles of high-speed rail lines in scarcely a decade, and they are planning to have triple that amount by 2020. The U.S., by comparison, has a grand total of 456 miles of high-speed rail lines—and even that’s stretching the definition of high-speed to the limit. Besides its national high-speed rail grid, China is developing an indigenous nuclear power industry, aerospace industry, fusion power research, and it has what is becoming the leading lunar and space exploration program internationally.

China is also the nation whose national banks have provided most of the productive credit to keep the world’s industry going since the 2008 Wall Street crash, while the U.S. Federal Reserve and its international partners in crime have done nothing but provide trillions in quantitative easing to bail out the bankrupt banks, while destroying the physical economy.

Going beyond that, through the Asian Infrastructure Investment Bank (AIIB) and the whole series of New Silk Road development banks and funds, China has begun to build new economic development corridors beyond its borders, across Eurasia by both land and sea, and in areas of Africa. It is ready to participate in building those corridors into North America, and in the United States. At the APEC meeting in Beijing in November 2014, Chinese President Xi Jinping, with President Obama standing at his side, formally invited the United States to leave confrontational geopolitics aside, and join the BRICS and allied nations in these endeavors, on a win-win basis.

Don’t expect Obama to take up that offer, however. He won’t. But the United States can and should—starting by removing Barack Obama from the White House by Constitutional means, and adopting the Hamiltonian development and credit policies which Lyndon LaRouche has championed for decades.

Americans can stop dying and killing themselves with “the disease of hopelessness” which has grown from our country’s collapse as an industrial nation. We must start building again; building our parts of the “world landbridge” of infrastructure development, to replace the onrushing New Dark Age with a new Golden Renaissance.

See attached for a high quality, large PDF of the report, for a smaller size version, see here.