Stagnation Nation: Middle Class Wealth Is Locked Up in Housing and Retirement Funds

One of my points in Why Governments Will Not Ban Bitcoin was to highlight how few families had the financial wherewithal to invest in bitcoin or an alternative hedge such as precious metals.

The limitation on middle class wealth isn’t just the total net worth of each family; it’s also how their wealth is allocated: the vast majority of most middle class family wealth is locked up in the family home or retirement funds.

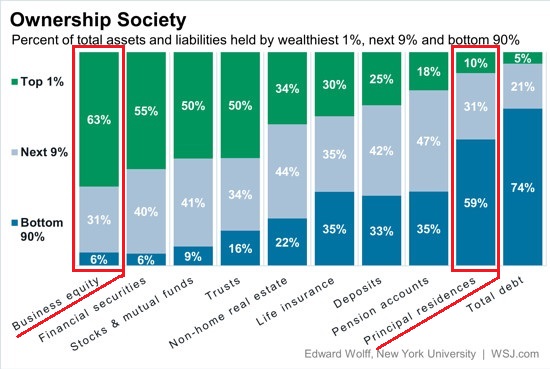

This chart provides key insights into the differences between middle class and upper-class wealth. The majority of the wealth held by the bottom 90% of households is in the family home, i.e. the principal residence. Other major assets held include life insurance policies, pension accounts and deposits (savings).

What characterizes the family home, insurance policies and pension/retirement accounts? The wealth is largely locked up in these asset classes.

Yes, the family can borrow against these assets, but then interest accrues and the wealth is siphoned off by the loans. Early withdrawals from retirement funds trigger punishing penalties.

In effect, this wealth is in a lockbox and unavailable for deployment in other assets.

IRAs and 401K retirement accounts can be invested, but company plans come with limitations on where and how the funds can be invested, and the gains (if any) can’t be accessed until retirement.

Compare these lockboxes and limitations with the top 1%, which owns the bulk of business equity assets. Business equity means ownership of businesses; ownership of shares in corporations (stocks) is classified as ownership of financial securities.

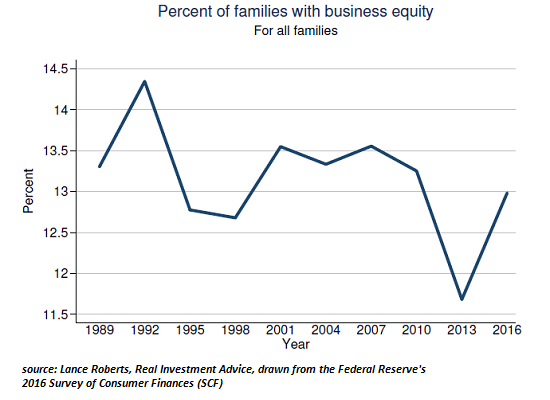

These two charts add context to the ownership of business equity. Note that despite the recent bounce off a trough, the percentage of families with business equity has declined for the past 25 years. The chart is one of lower highs and lower lows, the classic definition of a downtrend.

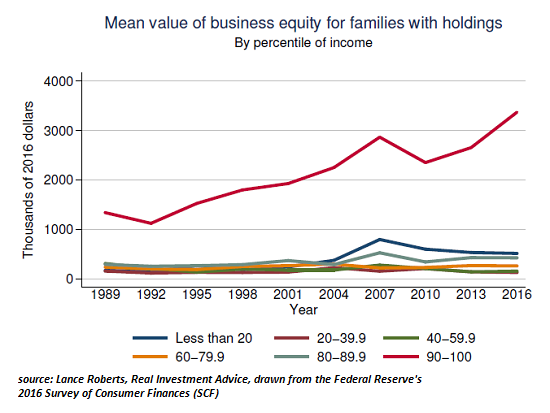

The mean value of business equity is concentrated in the top 10% of families.While the value of the top 10%’s biz-equity dropped sharply in the global financial crisis of 2008-09, it has since recovered and reached new heights, while the value of the biz equity held by the bottom 90% has flatlined.

Assets either produce income (i.e. they are productive assets) or they don’t (i.e. they are unproductive assets). Businesses either produce net income or they become insolvent and close down. Family homes typically don’t produce any income (unless the owners rent out rooms), and whatever income life insurance and retirement funds produce is unavailable.

This is the key difference between financial-elite wealth and middle class wealth: the majority of middle class wealth is locked up in unproductive assets or assets that only become available upon retirement or death.

The income flowing to family-owned businesses can be spent, of course, but it can also be reinvested, piling up additional income streams that then generate even more income to reinvest.

No wonder wealth is increasingly concentrated in the hands of the top 5%: those who own productive assets have the means to acquire more productive assets because they own income streams they can direct and use in the here and now without all the limitations imposed on the primary assets held by the middle class.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

Leave a Reply